Invesco Review: Invesco markets itself as a cutting-edge online trading and investment platform, offering access to forex, cryptocurrencies, commodities, and indices. The platform claims to use AI-driven trading algorithms, professional financial advisors, and real-time market analytics to help investors achieve consistent profits. Its marketing emphasizes guaranteed returns, portfolio growth, and financial independence, giving the impression of a legitimate international broker. However, verified complaints and investigations reveal that Invesco is an unregulated investment scam, deliberately designed to defraud investors through fabricated trading results, blocked withdrawals, and manipulative tactics.

Misleading Legitimacy and Fabricated Corporate Identity

Invesco attempts to appear credible by displaying fake regulatory certificates, fabricated license numbers, and unverifiable claims of compliance with respected financial authorities. Verification confirms that Invesco is not licensed or regulated by FCA (UK), ASIC (Australia), CySEC (Cyprus), or any recognized global authority. Investor funds are therefore entirely unprotected.

The listed corporate addresses often correspond to virtual offices or fictitious locations, while the “management team” is represented by stock images and fabricated biographies. Polished website design, professional dashboards, charts, and cloned marketing content are all part of a deliberate attempt to deceive investors and create false credibility.

Step-by-Step Breakdown of Invesco Scam Operations

1. Aggressive Online Marketing:

Invesco targets investors through social media campaigns, search engine promotions, and email advertisements. The platform promises “AI-driven profits” and “risk-free trading,” appealing to both beginner and experienced investors.

2. Low Initial Deposit:

Victims are encouraged to deposit small amounts, usually $250–$500, to “activate accounts” and see early returns, which are entirely fabricated.

3. Fake Trading Dashboard:

Deposited funds appear to grow on a manipulated interface, showing simulated profits disconnected from real market activity. This builds a false sense of confidence and encourages larger deposits.

4. Manipulative Account Managers:

Assigned “financial consultants” maintain frequent contact, praising early gains and urging higher deposits for VIP accounts, premium trading strategies, or exclusive investment tools.

5. Withdrawal Obstruction:

Withdrawal requests are blocked or delayed, with demands for additional deposits, “security fees,” or “tax clearance payments.” Victims face repeated excuses and technical issues to prevent access to their funds.

6. Account Lockout and Disappearance:

Once deposits stop, communication ceases. Accounts are blocked, dashboards disabled, and Invesco may vanish or rebrand under a new identity to continue targeting new victims.

Red Flags Identifying Invesco as a Scam

- No Regulatory License: Operates without FCA, ASIC, CySEC, or any recognized financial authority.

- Anonymous Ownership: Founders and directors remain undisclosed; corporate registration cannot be verified.

- Unrealistic Profit Promises: Promises of fixed daily, weekly, or monthly returns are impossible.

- High-Pressure Sales Tactics: Investors are repeatedly urged via calls, emails, and messages to deposit more funds.

- Fake Profit Displays: Dashboards artificially inflate balances disconnected from real trades.

- Blocked or Delayed Withdrawals: Verified reports confirm frozen accounts and ignored withdrawal requests.

- False Contact Information: Phone numbers, emails, and addresses are fake or untraceable.

- Cloned Website Content: Charts, graphs, testimonials, and website designs are often copied from other scam platforms.

- Fabricated Regulatory Documents: Certificates and licenses are fake and unverifiable.

- Pressure to Upgrade Accounts: Investors are coerced into VIP or premium accounts to unlock “higher profits.”

- Manipulative Account Managers: Assigned “experts” use psychological tactics to extract more deposits.

- Sudden Disappearance or Rebranding: After collecting deposits, the platform blocks access and may reappear under a new identity.

- Suspicious Payment Methods: Requests for cryptocurrency transfers or unregulated international bank transfers complicate recovery.

- Aggressive Retargeting: Investors are repeatedly targeted online to deposit more funds.

- Fake Testimonials and Reviews: Positive reviews are fabricated using stock images or copied content.

Professional Assessment of Invesco Operations

Invesco exhibits all hallmarks of a structured investment scam. Initial small profits are shown to build trust, followed by aggressive upselling. Deposited funds are routed through unregulated payment processors, offshore accounts, or cryptocurrency wallets, making independent recovery extremely difficult. Victims report total financial loss, frozen accounts, blocked communications, and harassment from affiliated scam networks. Fake licensing, manipulated dashboards, and sudden disappearance confirm deliberate intent to defraud investors globally.

How Amdark Limited Assists Invesco Victims

Amdark Limited specializes in recovering funds from unregulated investment scams. Our structured recovery approach includes:

1. Comprehensive Case Review:

Examining deposits, communications, and transaction history.

2. Fraud Verification:

Confirming Invesco’s illegal and unlicensed operations through professional investigation.

3. Evidence Compilation:

Collecting receipts, emails, chat logs, and other documentation to support recovery.

4. Fund Tracing:

Using blockchain forensics and financial tracking to locate stolen funds in banks and crypto wallets.

5. Chargeback & Legal Assistance:

Working with banks and authorities to initiate formal recovery processes.

6. Regulatory Communication:

Coordinating with global authorities to prevent further exploitation.

7. Client Support:

Providing continuous guidance, updates, and professional assistance throughout the recovery process.

Acting quickly significantly increases the likelihood of successful fund recovery.

Final Verdict: Invesco Confirmed as a Fraudulent Platform

Invesco is conclusively identified as a fraudulent, unregulated broker exploiting investors worldwide through fake profits, high-pressure tactics, and blocked withdrawals. Its anonymous ownership, false licensing claims, and manipulative marketing demonstrate criminal intent. Investors are strongly advised to avoid this platform entirely. Those who have already invested must act immediately, preserve all evidence, and contact Amdark Limited for professional recovery assistance. Connect with our expert recovery team today: www.amdarklimited.com.

Fill out the form below to get in touch with AMDARK LIMITED. Our team specializes in fund recovery and will work with you. The sooner you reach out, the faster we can step in to secure your case and help you recover what is rightfully yours.

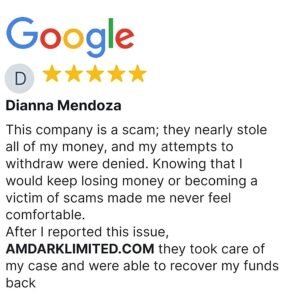

Carol Wiley

I got caught up in an Invesco scam, which was a terrible experience. Thankfully, I found AMDARKLIMITED.C0M, and they were able to help me get my money back. After talking with them about my situation, they took action and quickly got my funds returned in a matter of days. It was such a relief to have their support during a stressful time. I’m really thankful for their help.

Falling victim to a scam can leave you feeling helpless and confused. The emotional toll, mixed with the worry about lost money, can be overwhelming. When I realized I had been scammed by Invesco, I felt a mix of anger and desperation. I knew I needed to act fast, but I wasn’t sure where to turn.

Searching for help online, I came across AMDARKLIMITED.C0M. I was hesitant at first, as it’s hard to know who to trust in these situations. But after reading some testimonials and learning more about their services, I decided to reach out for a consultation.

The consultation process was reassuring. They listened carefully to my story, asked detailed questions, and explained how they could potentially recover my funds. They were transparent about the process, the potential challenges, and the fees involved. This honesty helped me feel more confident in their ability to help.

Once I engaged their services, the AMDARKLIMITED.C0M team acted swiftly. They used their expertise to track down my funds and work with the relevant authorities to get them returned. I was impressed by their dedication and the speed with which they worked.

To my surprise and relief, the funds were recovered within just a few days. The team kept me informed throughout the process, providing updates and answering any questions I had. It was a huge weight off my shoulders to have my money back.

I’m incredibly grateful to AMDARKLIMITED.C0M for their assistance in recovering my funds. They provided a professional, efficient, and supportive service during a difficult time. If you’ve been the victim of a scam, I would recommend reaching out to them for help. Their expertise and dedication can make a huge difference in getting your money back and restoring your peace of mind. Remember, it’s essential to do your research and seek assistance from reputable and trustworthy sources when dealing with such sensitive issues.

Carol Montes

Invesco is a fake investment company. They are avoiding me despite my months-long attempts to get my investment back. I eventually submitted a legal complaint with AMDARKLIMITED.C0M, and I was promised a complete refund. They took good care of me, and their staff was really supportive. AMDARKLIMITED.