Royal Wealth Scam Investigation: Royal Wealth presents itself as an elite wealth-building ecosystem designed for forex, crypto, commodities, and global indices. With polished web content, glossy earnings claims, and fake “expert advisor” credibility, the platform attempts to project trust and financial sophistication. However, detailed investigations reveal that Royal Wealth (royal-wealthltd.com) functions as an unregulated, high-risk online scam whose purpose is to trick investors into depositing money that will never be returned. This official warning exposes Royal Wealth’s deceptive inner workings, the red flags signaling fraud, and how victims can pursue fund recovery with Amdark Limited.

How the Royal Wealth Scheme Operates: The Real Mechanism Behind the Scam

Royal Wealth follows a calculated, multilayered manipulation model designed to attract victims, fabricate trust, and block withdrawals. Their operational flow includes:

- Targeting Victims Through Precision Advertising

Royal Wealth floods social media, Google ads, and trading forums with promotions promising “instant financial growth,” “automated profit engines,” and “expert-guided investments.”

- Immediate Contact from Fake Advisors

Once a user signs up, they receive persistent calls from scripted sales agents. These individuals pretend to be analysts or certified financial planners; none of which is true.

- Fast Deposit Pressure

Victims are urged to deposit small starter amounts ($250–$500) under the claim that the “algorithm performs best with quick activation.” This urgency is designed to eliminate hesitation.

- Fake Trading Dashboard

Royal Wealth does not access real financial markets. Instead, it uses a simulated system where prices, charts, and profits are artificially generated to show exaggerated gains.

- Strategic Psychological Manipulation

The fake advisors exploit emotional triggers, fear of missing out, greed, urgency, and trust – to escalate victims into investing larger amounts.

- Upselling Through Premium Account Tiers

Victims are told they must “upgrade their account” or “increase liquidity” to unlock higher returns or avoid losing current profits.

Common upsells include:

- VIP Trading Suite

- Auto-Investor Pro

- Expert Portfolio Management

- Wealth Maximizer Tier

All of these are completely fake.

- Blocking Withdrawals on Purpose

When users try to withdraw, Royal Wealth introduces fabricated financial barriers:

Examples include:

- “Trade volume requirements”

- “Withdrawal clearance tax”

- “Anti-money laundering fee”

- “High-level verification freeze”

- “Liquidity adjustment deposit”

These obstacles are intentionally created to prevent victims from accessing their funds.

- Cutting Off Communication

Once users stop depositing, Royal Wealth blocks accounts, deletes chat history, or stops responding.

This layered method allows the scam to extract as much money as possible before disappearing.

Major Red Flags Confirming Royal Wealth Is a Scam

Royal Wealth triggers multiple established indicators of investment fraud. These warning signs confirm its illegitimacy:

- No Regulatory Registration

There is no official license, no registration number, and no recognition by any global financial authority. Operating without regulation is a direct violation of international trading laws.

- Hidden Company Ownership

Royal Wealth provides no details about its parent company, headquarters, or management team. Full anonymity is a clear sign of criminal intent.

- Impossible Profit Guarantees

Claims of “consistent daily profits,” “zero-risk investing,” and “guaranteed earnings” are not only false; they are illegal.

- Fake Trading Environment

The trading interface is a controlled simulation with no connection to real liquidity, brokers, or market data.

- High-Pressure Tactics

Agents push victims to deposit more using emotional manipulation, threats of missed opportunities, and fabricated market insights.

- Zero Transparency in Policies

The terms and conditions are vague, contradictory, and designed to justify blocking withdrawals.

- Withdrawal Denial

All victims report the same problem: once money is deposited, it cannot be retrieved under any circumstances.

- Fake Reviews and Paid Testimonials

Artificially generated reviews attempt to mask the platform’s fraudulent nature. Meanwhile, real user reports online expose significant financial losses.

How Royal Wealth Manipulates Its Victims

Royal Wealth uses a consistent, staged manipulation process:

- False Sense of Expertise

Agents present themselves as licensed advisors with years of experience.

- Artificial Success Indicators

Fake dashboards show rapid profits to trap victims emotionally and financially.

- Escalation Through Fear

Victims are told they must deposit more or risk losing their “current earnings.”

- Withdrawal Entrapment

Every withdrawal attempt triggers a new set of impossible requirements.

- Abrupt Disappearance

When victims push back, Royal Wealth cuts communication completely.

These techniques are intentionally engineered to maximize financial extraction.

How Amdark Limited Helps Royal Wealth Victims Recover Their Money

Amdark Limited provides professional support for victims of unlicensed trading platforms, crypto scams, and online investment frauds. With advanced investigative tools and global expertise, Amdark Limited helps clients navigate the complex recovery process.

Their services include:

- Forensic transaction analysis

- Blockchain tracing for crypto payments

- Preparation of chargeback and dispute files

- Evidence collection for legal and regulatory complaints

- Strategic recovery planning customized for each victim

- Coordination with international cybercrime units

Victims should avoid further contact with Royal Wealth and never pay additional “fees,” as these are part of the scam.

Final Verdict: Royal Wealth Is a Dangerous and Unregulated Scam

Royal Wealth is conclusively identified as a fraudulent investment scheme. Its fake trading system, hidden operators, guaranteed-profit claims, and deliberate withdrawal obstruction prove that the platform was built to deceive and financially exploit investors. Users must avoid this platform at all costs and warn others in their network.

Start Your Recovery Journey with Amdark Limited Today

If you have lost money to Royal Wealth, Amdark Limited can help you begin the recovery process immediately. With expert analysts, fraud specialists, and global investigative tools, the team offers structured support to trace lost funds and pursue effective recovery steps.

Visit www.amdarklimited.com to submit your confidential case assessment today.

Timely action is essential; scammers move money quickly through anonymous networks.

Fill out the form below to get in touch with AMDARK LIMITED. Our team specializes in fund recovery and will work with you. The sooner you reach out, the faster we can step in to secure your case and help you recover what is rightfully yours.

Leigh Macdonald

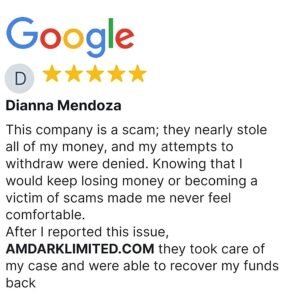

When I tried to withdrawal from Royal Wealth and it didn’t work. This made me concluded it might be a scam. They kept asking me for more money, which was really suspicious. Luckily, I found out about AMDARKLIMITED.C0M, and that helped me get all my 380,050 EURO back.

Lawanda Norman

Royal Wealth scammed me, plain and simple. They took over €579,500 from me and refused to let me withdraw a single cent, no matter how many times I tried or how many excuses they made. It was a devastating experience, and I felt completely helpless as I watched my hard-earned money disappear with no way to access it. The only reason I managed to get my money back was thanks to AMDARKLIMITED.COM. Their team handled my case professionally and guided me through the recovery process step by step, providing support and updates at every stage. If you move fast, you can still get your funds back too. Don’t wait—acting quickly can make all the difference, and you don’t have to go through this alone.

Ernesto Marquez

Royal Wealth is a scam…. I’ve been unsuccessfully trying to get my money out for months. They are ignoring me. I’ve been cursing myself for trusting them blindly. My sister recommended that I check out AMDARK LIMITED * C0M, which helped me recover my funds in a matter of days.